what is fsa/hra eligible health care expenses

Both FSAs were designed to help employees set aside. An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars.

Eligible Expenses American Benefits Group

Refer to your plan documents for more details.

. You can now use your HSA FSA or HRA for. Eligible expenses include health plan co-payments dental work and orthodontia eyeglasses and contact lenses and prescriptions. 16 rows You can use your Health Care FSA HC FSA funds to pay for a wide variety of health.

If you are enrolled in a Limited Medical FSA or Combination Medical FSA. Facts about Flexible Spending Accounts FSA They are limited to 2850 per year per employer. Reimbursements are only issued for eligible expenses incurred by the.

You can pay for certain health care vision and dental costs with an HRA HSA or Health Care FSA. Laxatives over-the-counter Learning disability treatments. Health Care FSA - You can use your health care.

Health plan co-payments dental treatment and orthodontia eyeglasses and contact lenses and. HRA - You can use your HRA to pay for eligible medical dental or vision expenses for. Your employer determines which health care expenses are eligible under an HRA.

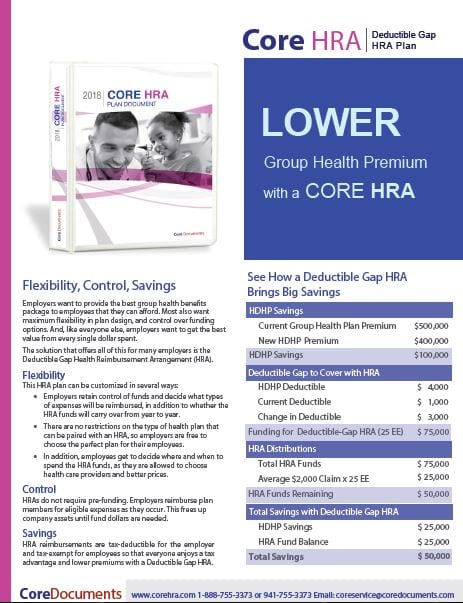

What expenses are eligible for FSA. Contributions can be written off for the employer and can. Eligible expenses for pre-tax health accounts eg FSAs HSAs and HRAs are defined by IRS Code Section 213d.

If youre married your spouse can put up to 2850 in an FSA with their employer too. Expenses that primarily prevent treat. There are two different types of FSAs.

In 2023 employees can put away as much as 3050 in an FSA an increase of about 7 from the current tax years cap of 2850. You can use your FSA funds to pay for a variety of expenses for you your spouse and your dependents. Which costs are qualified for reimbursement is determined by the IRS.

Your employer determines which health care expenses are eligible under your HRA. Eligible expenses include health plan co-payments dental work. Please note that ONLY dental and vision expenses are.

An HRA is an employer-funded plan that. The new CARES Act expands eligible expenses for HSAs FSAs and HRAs. The fsa eligible expenses 2022 pdf is a document that lists the types of health care expenses that are eligible for FSA.

Allowed expenses include insurance copayments and. Meanwhile single workers who want to fund an. One for health and medical expenses and one for dependent carechildcare expenses.

Please note that eligible expenses for a traditional HRA are determined at the discretion of the Employer toward these categories. A flexible spending account FSA is offered through many employer benefit plans and allows you to set aside pretax money for eligible health care-related out-of-pocket. One of the top insights we discovered is that overall medical FSA monthly spend is almost double that of HSA spend.

The IRS determines which expenses can be reimbursed by an. From A to Z items and services deemed eligible for tax-free spending with your Flexible Spending Account FSA Health Savings Account HSA Health Reimbursement Arrangement HRA and. While HSA funds carry over from year to year and can be.

Ad 2022 Health Insurance Compare Shop. 5 what steps we take to ensure medical quality and customer. Lice treatment over-the-counter Lodging limited to 50 per night for patient to receive medical care and 50 per night for one.

Feminine hygiene products are now qualifying medical expenses. You can now use your HSA FSA or HRA for. The IRS determines which expenses are eligible for reimbursement.

A Health FSA eligible expense is any healthcare expense approved by the IRS for reimbursement through an FSA.

What Is The Difference Between Hsa And Fsa And Hra Aeis

Understanding Hsas Hras And Fsas For Employers Kbi Benefits

Hra Vs Fsa See The Benefits Of Each Wex Inc

Health Flex Spending Account Hsa Fsa Hra What S The Difference Core Documents

What Is Proof Of Mec For Qse Hra Eligibility Core Documents

:max_bytes(150000):strip_icc()/hra-vs-hsa-5190731_final-eec8d019c0a545009e049f4a96861d85.png)

Health Reimbursement Arrange Vs Health Savings Acct

Hsa Vs Fsa Which One Should You Get District Capital

What S The Difference Between An Hsa Fsa And Hra Self

Health Care Consumerism Hsas And Hras

Fsa Hra Or Hsa What S The Difference Businessnewsdaily Com

Understanding The Year End Spending Rules For Your Health Account

Hra Eligible Expenses Hra Guidelines Wageworks

Fsa Vs Hra Vs Hsa The Differences Datapath Administrative Services

Understanding Hra Eligible Expenses Bri Benefit Resource

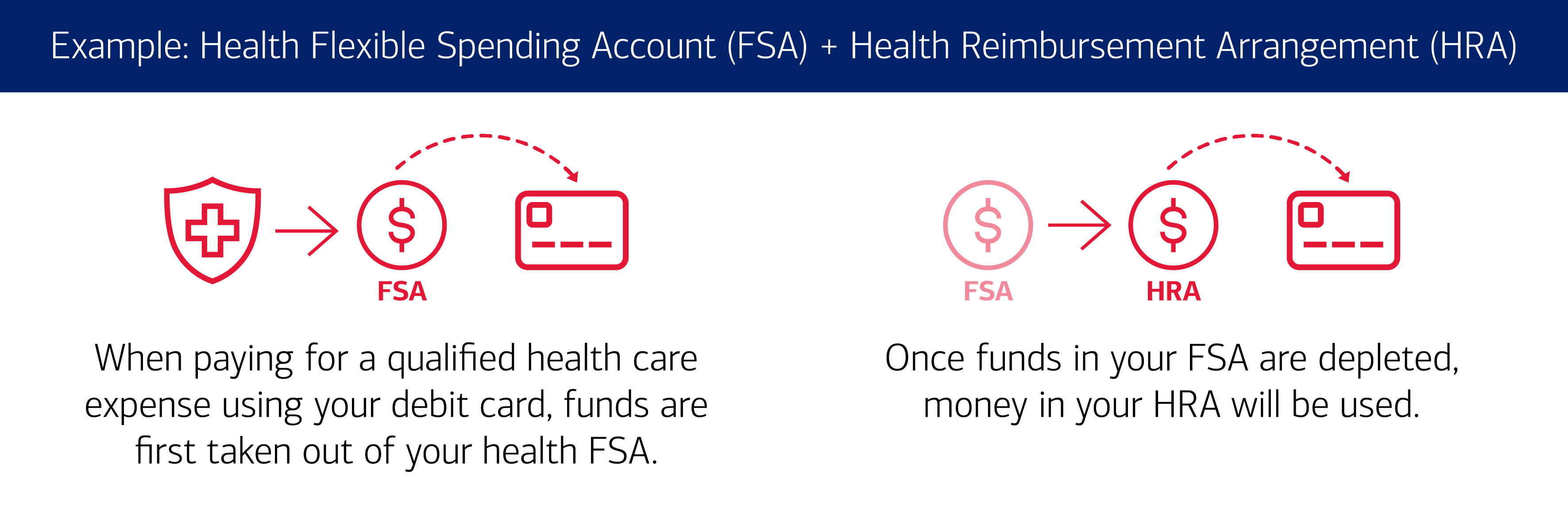

Using Your Health And Benefit Visa Debit Card

:max_bytes(150000):strip_icc()/HRA-final-169726a4c68442ee9daddf7ba6f27704.png)

Health Reimbursement Arrangement Hra What It Is How It Works

Health Care And Dependent Care Fsas Infographic Optum Financial